Frequently Asked Questions

How are school districts funded in Wisconsin?

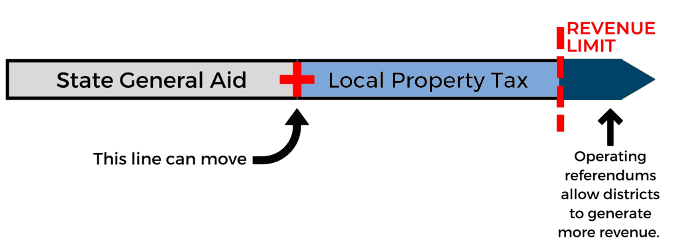

All school districts' tax mill rates are controlled by the state via a formula called the revenue limit. The purpose of the revenue limit is to cap - or limit - the amount of money a district generates from the two largest sources of school funding (revenue): state equalization aid and property taxes.

In the funding formula, these two sources of revenue balance each other to total the revenue limit for the district. If a district receives more state equalization aid, then they levy for less property taxes. If a district receives less state equalization aid then they levy for more property taxes. However, total revenue may not exceed the limit set by the state.

Wisconsin School Finance 101 - Watch now!

This new short video (click to view), created by WSPRA & WASBO, provides a great explanation of why so many Wisconsin school districts are finding that an operational referendum is necessary. (𝘞𝘚𝘗𝘙𝘈 | 𝘞𝘪𝘴𝘤𝘰𝘯𝘴𝘪𝘯 𝘚𝘤𝘩𝘰𝘰𝘭 𝘗𝘶𝘣𝘭𝘪𝘤 𝘙𝘦𝘭𝘢𝘵𝘪𝘰𝘯𝘴 𝘈𝘴𝘴𝘰𝘤𝘪𝘢𝘵𝘪𝘰𝘯 --𝘞𝘈𝘚𝘉𝘖 | 𝘞𝘪𝘴𝘤𝘰𝘯𝘴𝘪𝘯 𝘈𝘴𝘴𝘰𝘤𝘪𝘢𝘵𝘪𝘰𝘯 𝘰𝘧 𝘚𝘤𝘩𝘰𝘰𝘭 𝘉𝘶𝘴𝘪𝘯𝘦𝘴𝘴 𝘖𝘧𝘧𝘪𝘤𝘪𝘢𝘭𝘴)

Lake Geneva Schools Finance Overviews

Join George Chironis, Director of Business Services for Lake Geneva Schools, to learn more about school finance and how it impacts the Lake Geneva Joint #1 School District and the Lake Geneva-Genoa City Union (Badger) High School District. Click here to watch the videos.

What is a revenue limit?

Wisconsin public schools receive most of their revenue from state general aid and property taxes. A revenue limit is the maximum revenue that a school district can receive through state general aid and property tax.

In this image, the red plus sign can move. This means the state can decide to provide more or less funding in the state budget - which influences local property taxes. The red bar at the right moves when the state adds a per pupil increase or when community members grant permission to exceed the revenue limit. NOTE: the state did not add a per pupil increase in the 2021-2023 state budgets - though the fixed costs to run schools did increase.

What is an operational referendum?

Operational referendums are the vehicle that allows school districts to increase their amount of spending to meet rising infrastructure and operational costs. If a school district needs additional revenue to maintain or increase its operational needs, such as staffing, supplies, and/or equipment, then it can ask the taxpayers of the district to approve the spending of additional dollars to support the school by agreeing to raise the property taxes of the district. If the referendum passes, then the district can increase its spending by the amount of money approved by the taxpayers. If it fails, then the district cannot access these additional funds.

Over 85% of all school districts in Wisconsin have utilized an operational referendum. Operational referendums are the “new normal” or the new expectations set forth by the state to provide local control for communities.

What is the difference between a capital and an operational referendum?

School districts may initiate two types of referendums to increase funding - capital and operational.

One type of referendum that a district may consider is a referendum to issue debt for a specified purpose. These are often referred to as “capital referendum,” because the funds are typically (but not always) for construction and other large capital projects. A capital referendum provides the authority to issue a certain amount of bonds/notes to pay for a capital project.

The second type of referendum a district may initiate is a referendum to exceed its revenue limit without issuing new debt. These are referred to as an “operating referendum.” An operating referendum provides additional revenue to pay for the operational expenses of the District, such as salaries/benefits, educational programming, routine maintenance, utilities, etc.

What will referendum funds be used for?

If approved, referendum funds would be used to address the ongoing operational and maintenance expenses, infrastructure, technology and safety upgrades, and educational programming. Our top priorities for these funds would be:

(1) Support for teaching and learning to increase student growth and achievement and offer competitive academic courses, programs, and services for all students

(2) Attract and retain the best educators by providing competitive salaries and benefits

(3) Address annual, ongoing maintenance on our aging buildings

(4) Cover rising inflationary costs on goods and services, including transportation, utilities, curriculum, supplies, and equipment

What have the districts done to be fiscally responsible?

Both districts have continued their long-standing tradition of excellence while being fiscally responsible.

- Since 2019, the districts have made enrollment-driven reductions of certified staff through attrition and realignment based on current educational best practices. Over the last five school years, the districts have reduced over 30 certified staff positions.

- Over the last two school years, both districts used their one-time ESSER Grant Funds to cover ongoing costs, which will be exhausted by June 2024.

- This year (2023-2024), the districts reduced their overall building budgets by 5% and increased employee contributions to health insurance.

- The Boards of Education of Badger and Joint #1 have a Shared Service Agreement. The benefits to our school community include more collaborative coordination of the educational and operational programs K-12. This agreement provides a more efficient use of taxpayer dollars by reducing costs for both Districts.

Isn’t enrollment declining?

Yes, enrollment within Lake Geneva-Genoa City Union (Badger) High School District and Lake Geneva Joint #1 School District has been declining over the past 10 years, and it is anticipated to continue to decline over the next few years.

According to an enrollment projections analysis for Badger High School and Lake Geneva Joint #1 School District conducted by the Applied Population Laboratory, University of Wisconsin-Madison:

- All projection models show a similar trend and project enrollment to decline for Badger High School, averaging an 11.4% decrease.

- Enrollment is projected to decline over the next five years, averaging an 11.0% decrease for the Joint #1 School District.

However, fewer students does not necessarily mean less cost. The needs of our students have also increased significantly, particularly in the areas of special education, mental health, economically disadvantaged students, and multi-language learners. These represent essential services mandated by state and federal regulations for which the district receives inadequate funding.

Additionally, expenses related to wages and benefits, transportation, and heating and cooling school facilities are rising, along with various other costs beyond the district's control.